In today’s digital age, online shopping has become an integral part of our lives. With just a few clicks, consumers can explore a vast range of products and have them delivered right to their doorstep. As the e-commerce industry continues to thrive, certain shopping categories have emerged as global favorites, capturing the attention and wallets of millions worldwide. From cutting-edge electronics to fashionable apparel and everything in between, this article delves into the top shopping categories that have captured the world in 2022-2023. Join us as we explore the online shopping trends, statistics, innovation, and consumer preferences that shape the exciting landscape of global e-tail.

Most popular eCommerce product categories worldwide

Although online selling trends may vary from year to year, the top ten global shopping categories remained the same. Only the order changes. Here is the list of the top trending items:

- Electronics and Gadgets: This eCommerce category includes smartphones, laptops, tablets, and other electronic devices.

- Fashion and Apparel: Clothing, shoes, accessories, and fashion-related items are top eCommerce products to sell.

- Home and Kitchen Appliances: Products like kitchen gadgets, home decor items, and appliances are commonly purchased through the web.

- Health and Beauty: Skincare products, cosmetics, supplements, and personal care items are in high demand in this category.

- Toys and Games: Children’s toys, video games, and board games are frequently purchased online.

- Books and Media: Physical books, e-books, music, movies, and other forms of media are commonly sold on the web.

- Furniture and Home Decor: Furniture web shops offer a wide range of products for home furnishing and decor.

- Sports and Fitness: Exercise equipment, sports gear, and fitness accessories are common eCommerce products.

- Baby and Maternity: Products for infants, toddlers, and expecting mothers, including baby gear and maternity clothing.

- Groceries and Food: Online grocery shopping has seen significant growth, especially during the COVID-19 pandemic.

However, this is just general data that doesn’t cater to local specifics. Let’s consider the top shopping categories in different parts of the world.

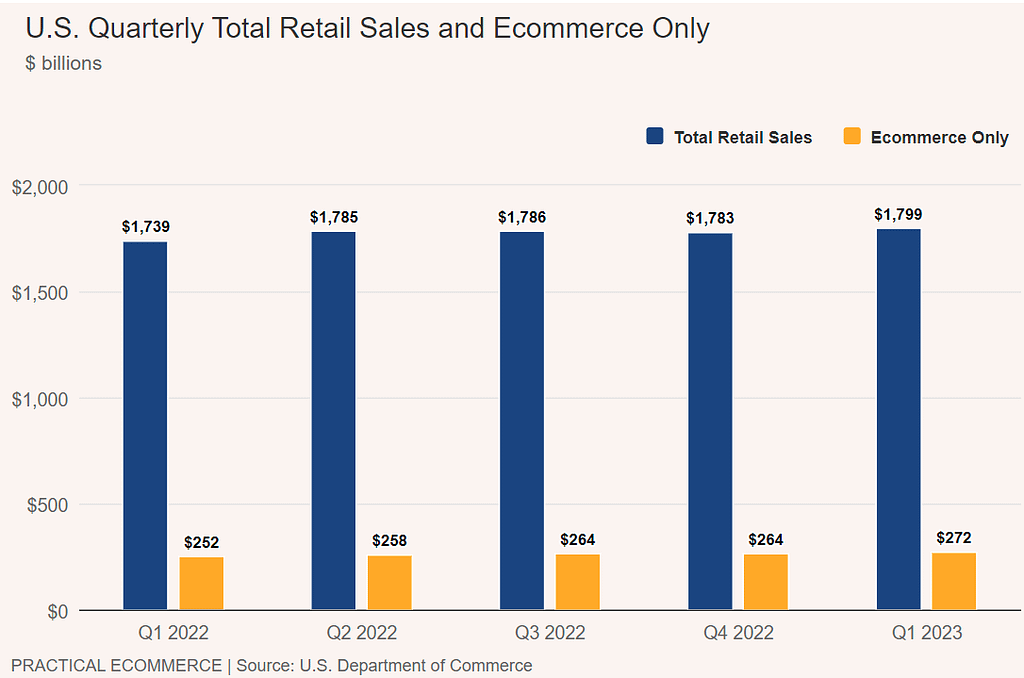

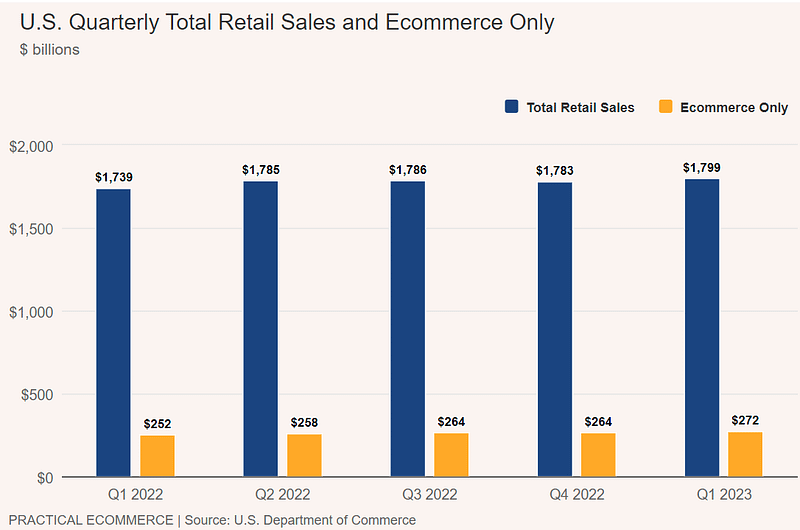

U.S. eCommerce market overview

The U.S. eCommerce market has been experiencing significant growth over the past decade, and this trend is expected to continue in the coming years. Factors such as increasing internet penetration, widespread adoption of smartphones, and changing preferences of potential customers have been driving this growth.

According to various reports and studies, the U.S. eCommerce market is foreseen to reach new heights by 2023. While the exact figures may vary, it is expected that the market will continue to expand and account for a larger share of overall retail sales.

Some key trends that are likely to shape the U.S. online trade in 2023 include:

- Mobile Commerce: Retailers are focusing on optimizing their websites and apps for mobile devices to provide a seamless shopping experience.

- Omnichannel Retailing: This includes integrating digital and physical inventory, offering click-and-collect options, and leveraging emerging technologies like augmented reality (AR) and virtual reality (VR) to enhance the customer experience.

- Personalization and AI: Artificial intelligence (AI) and machine learning (ML) technologies are being used to personalize the online shopping experience. Retailers are leveraging customer data to offer personalized recommendations, targeted promotions, and tailored shopping experiences.

- Sustainability and Ethical Consumption: Consumers are increasingly conscious of sustainability and ethical practices.

Market Consolidation and Competition: The eCommerce market is highly competitive, and consolidation is expected to continue as larger players acquire smaller ones to gain a competitive edge. This consolidation may lead to increased competition and innovation in the market.

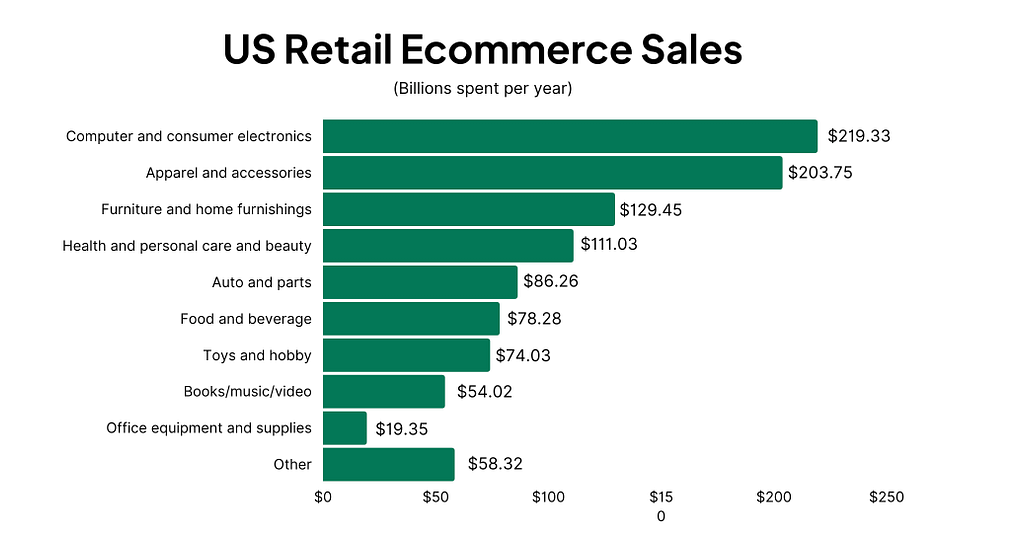

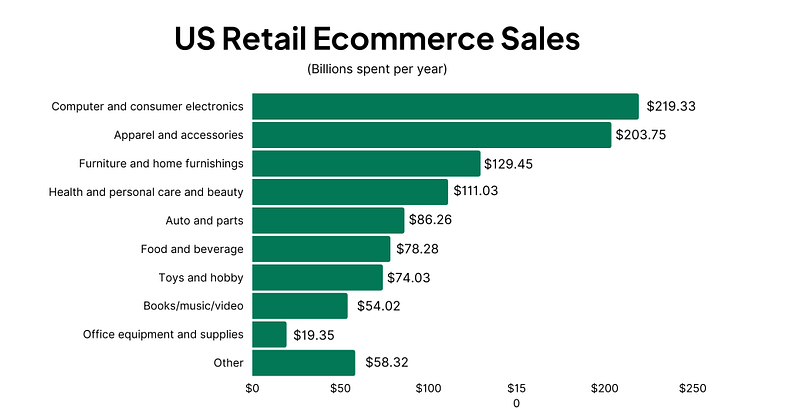

U.S. online shopping categories overview

Source: mobiloud.com

The most trending eCommerce products in the U.S. include:

- Computer and consumer electronics: $219.33 billion (21.2% of total sales in the US market). E-tailers like Amazon, Best Buy, and Newegg are popular destinations for purchasing electronics online.

- Apparel and accessories: $203.75 billion (19.7%). Retailers like Amazon, Walmart, and fashion-specific web stores like ASOS and Zara have a strong presence in this category.

- Furniture and home furnishings: $129.45 billion (12.5%). Retailers like Home Depot, Lowe’s, and Wayfair are the most frequent choices for purchasing these items on the web.

- Health and personal care and beauty: $111.03 billion (10.7%). Online beauty retailers like Sephora and Ulta, as well as general retailers like Amazon and Walmart, offer a wide range of health and beauty products.

- Auto and parts : $86.26 billion (8.3%). Retailers like AutoZone, Advance Auto Parts, and Amazon provide a wide selection of automotive products on their websites.

- Food and beverage: $78.28 billion (7.6%). Online grocery shopping has seen significant growth in the U.S., especially during the COVID-19 pandemic. Retailers like Amazon Fresh, Instacart, and Walmart Grocery offer grocery delivery services.

- Toys and hobby: $74.03 billion (7.2%). Retailers like Buy Buy Baby, Target, and Amazon offer a wide range of products for infants, toddlers, and expectant mothers.

- Books/music/video: $54.02 billion (5.2%). Amazon, Barnes & Noble, and other online bookstores are trending destinations for purchasing books electronically. Streaming services like Netflix and Amazon Prime Video are also widespread for movies and TV shows.

These categories represent some of the top-selling categories in the U.S., but there are many other niche categories that digital entrepreneurs can explore to diversify their product range.

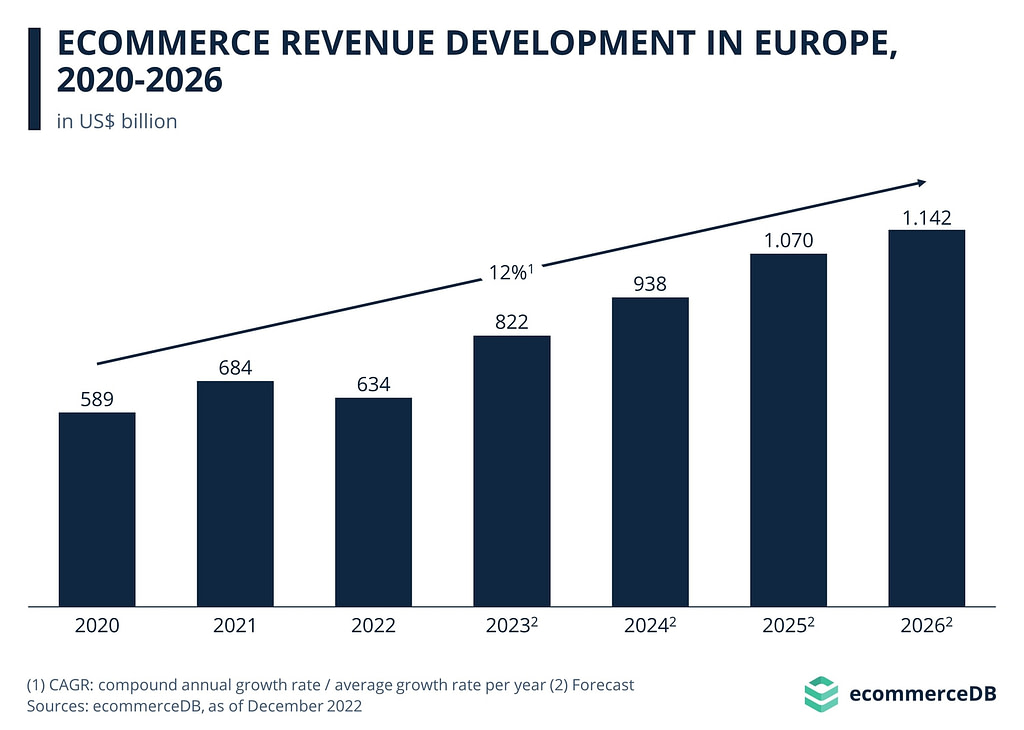

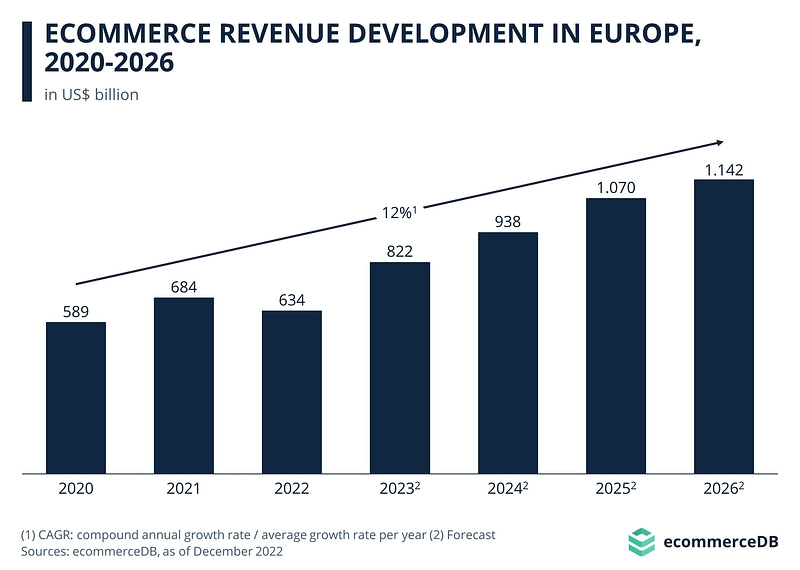

European eCommerce market overview

The European eCommerce market is foreseen to reach a value of around USD 822 billion in 2023, representing a significant increase from previous years. This growth can be attributed to the expanding online consumer base and the increasing number of online retailers. Several factors contribute to this positive outlook, including:

- Cross-Border Trade: Improved logistics and shipping services, the best dropshipping options, along with simplified customs regulations are facilitating this trend. As a result, European consumers have access to a wider range of products and can benefit from competitive pricing.

- Marketplaces: Digital eCom platforms continue to dominate the European eCommerce landscape. Platforms like Amazon, eBay, and Alibaba’s AliExpress have a significant presence in the region. These marketplaces offer a wide variety of products, attract a large customer base, and provide a convenient shopping experience. Additionally, local marketplaces, such as Zalando and Cdiscount, are gaining popularity in their respective markets.

- Omnichannel Retailing: Retailers are increasingly adopting an omnichannel approach, integrating their online and offline channels to provide a seamless shopping experience. This strategy allows customers to research, purchase, and return products through multiple channels, such as websites, mobile apps, and physical stores.

- Sustainability and Ethical Consumerism: Retailers that prioritize sustainability and communicate their ethical practices are likely to gain a competitive advantage.

- Regulatory Landscape: The European Union has implemented various regulations to protect consumer rights and ensure fair competition in the eCommerce market. The General Data Protection Regulation (GDPR) and the revised Payment Services Directive (PSD2) are examples of such regulations. Compliance with these regulations is crucial for online retailers operating in the European market.

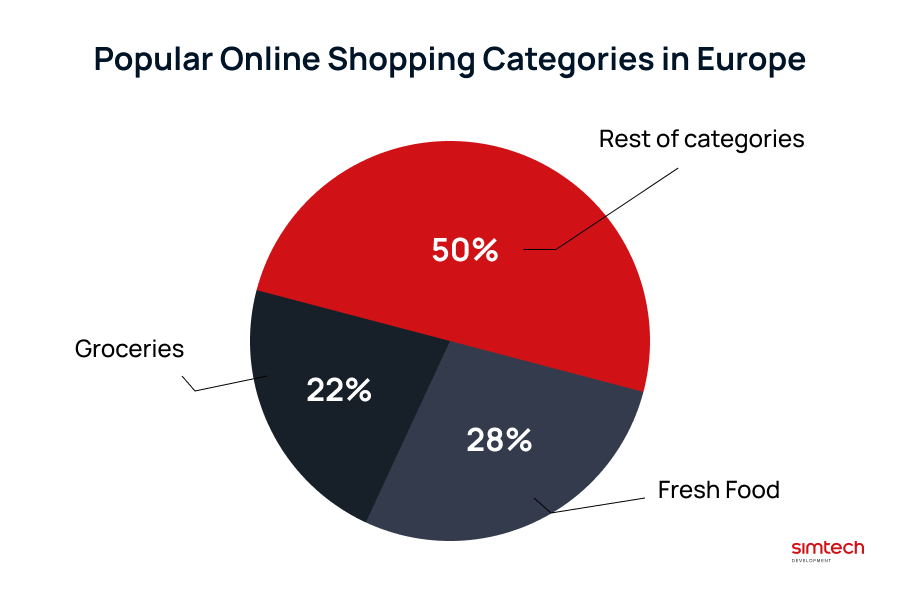

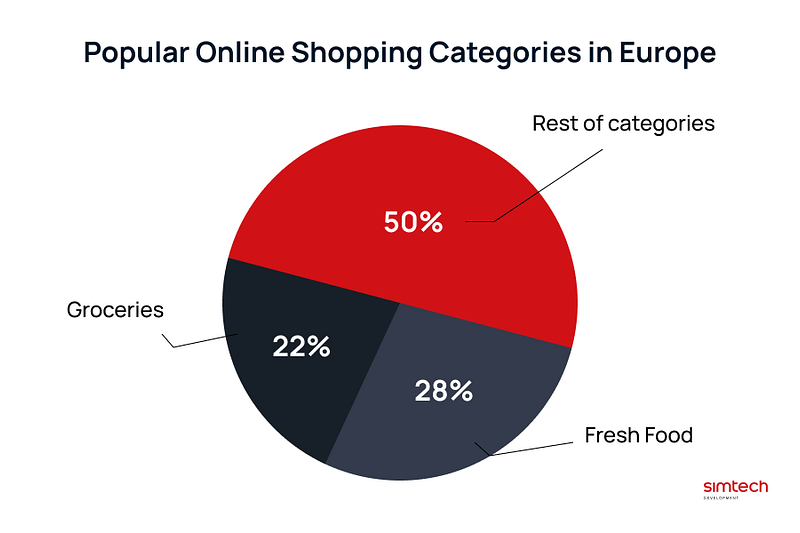

Europe Online Shopping categories overview

About 28% of European shoppers stated that they spent their income on fresh food and beverages in 2022 (Source: Statista). 22% claimed they bought groceries on a website.

Overall, the list of the top eCommerce categories in Europe included:

- Groceries and Food: Online grocery shopping has gained traction in Europe, particularly in urban areas. Retailers like Ocado, Tesco, and Carrefour offer grocery delivery services, and platforms like Deliveroo and Uber Eats provide food delivery from restaurants.

- Fashion and Apparel: Clothing, shoes, accessories, and fashion-related items are among the most trending products to sell in this segment in Europe. Online fashion retailers like Zalando, ASOS, and Boohoo have a strong presence in the European market.

- Electronics: Electronics and gadgets, including smartphones, laptops, TVs, and other tech products, are commonly purchased on the Internet in Europe. Retailers like Amazon, MediaMarkt, and Fnac are the most common destinations for buying electronics online.

- Home and Kitchen Appliances: Europeans often purchase home appliances, kitchen gadgets, and other related products through the web. Retailers like IKEA, MediaMarkt, and Amazon offer a wide range of options for shoppers.

- Health and Beauty: Skincare products, cosmetics, fragrances, and personal care items are popular in this category in Europe. Online beauty retailers like Feelunique, Lookfantastic, and Sephora have a strong presence in the European market.

- Books and Media: Physical books, e-books, music, movies, and other forms of media are commonly purchased online in Europe. Digital bookstores like Amazon, Book Depository, and Waterstones, as well as digital platforms like Kindle and Audible, are popular choices for purchasing books and media on the web.

- Home and Garden: Online shopping for furniture, home decor, gardening tools, and other home-related products is popular in Europe. Retailers like IKEA, Wayfair, and Home24 offer a wide range of options for online shoppers.

- Sports and Outdoor: Europeans frequently purchase sports equipment, outdoor gear, and fitness accessories online. Retailers like Decathlon, Sports Direct, and Amazon cater to the sports and outdoor needs of users.

- Travel and Accommodation: Online travel agencies and booking platforms like Booking.com, Expedia, and Airbnb are popular for booking flights, hotels, vacation rentals, and other travel-related services across Europe.

- Automotive: E-shopping for automotive parts, accessories, and even vehicles is also popular in Europe. Retailers like Autodoc, Euro Car Parts, and AutoScout24 cater to the automotive needs of online shoppers.

These categories represent some of the popular digital shopping destinations in Europe, but consumer preferences can vary across different European countries and regions.

Australian eCommerce market overview

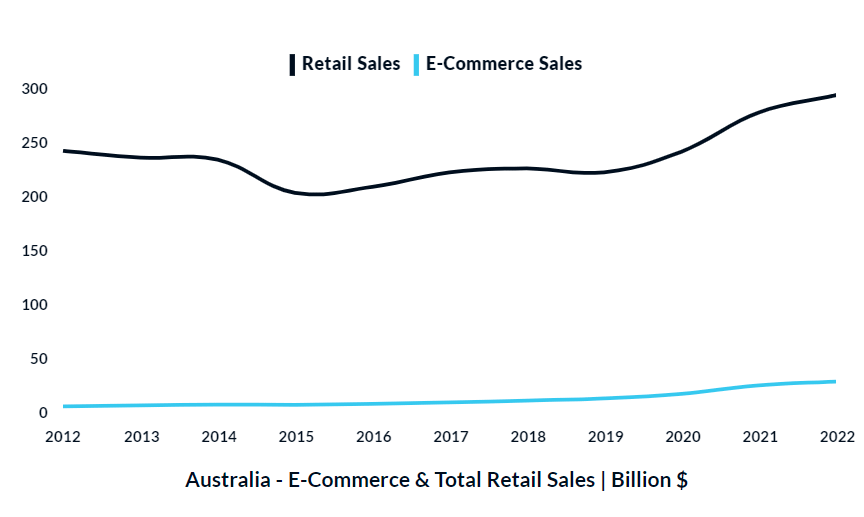

Source: OOSGA

The online market in Australia is growing steadily. In 2022, total online retail sales in Australia reached AUD 29 billion, accounting for around 10% of total retail sales. The market is expected to continue growing in the coming years. Some of the key players in the Australian online business include Amazon, eBay, Kogan, Catch, and The Iconic. These platforms offer a wide range of products and have a strong presence in the Australian market. Consumer trust and security are important factors in the Australian eCommerce market. Retailers are focusing on providing secure payment gateways, protecting customer data, and offering reliable customer support to build trust with online shoppers. Credit and debit cards are the most commonly used payment methods for e-shopping in Australia. However, alternative payment methods like digital wallets (e.g., Apple Pay, Google Pay) and Buy now, Pay later services (e.g., Afterpay, Zip) are also gaining popularity.

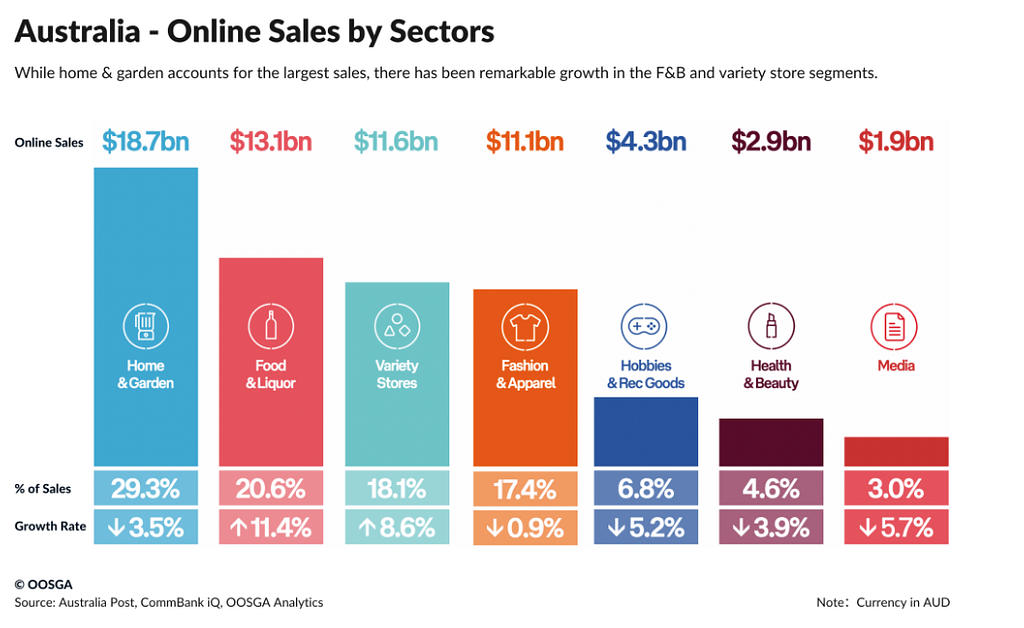

Australia Online Shopping Categories

According to market research agency OOSGA, the top growing online store categories in 2022 were Home & Garden and Food and Liquor segments. The latter category showed the highest growth rate in a year. Other high-demand categories in Australia include fashion and apparel, electronics, home and kitchen appliances, health and beauty products, sports and fitness equipment, and baby and maternity products.

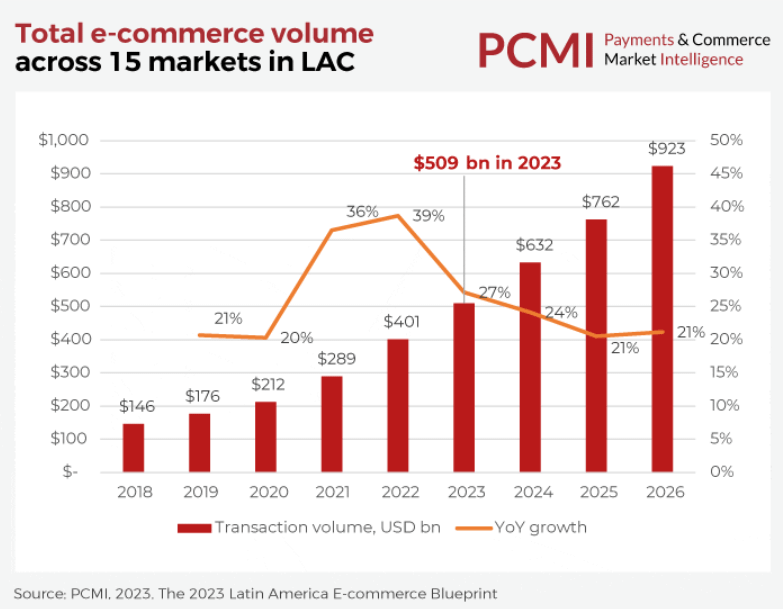

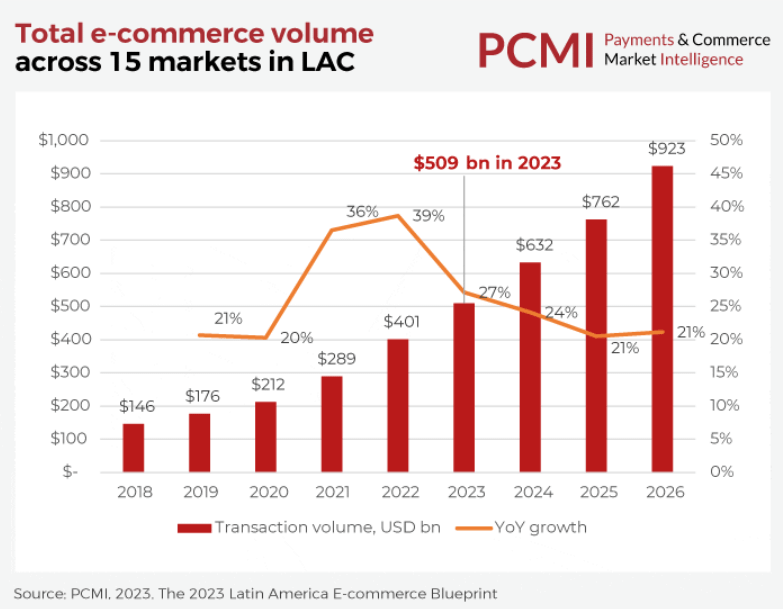

Latin America’s eCommerce market overview

The eCommerce business in Latin America presents significant opportunities for businesses. With a large and digitally connected population, increasing internet penetration, and a growing middle class, electronic trade is becoming increasingly widespread across the region. Some of the key players in the Latin American market include MercadoLibre, B2W Digital, Linio, and Amazon. MercadoLibre, often referred to as the “Amazon of Latin America,” is the largest web platform in the region and offers a wide range of products across various categories. Other factors contributing to the eCommerce growth include:

- Cross-Border Shopping: Consumers often order from international eCommerce platforms, particularly from the United States and China, for a wider product selection and competitive pricing.

- Payment Methods: While credit/debit cards are commonly used, alternative payment methods such as cash on delivery (COD), bank transfers, and digital wallets are also popular. Online trade platforms have been partnering with local payment providers to offer convenient and secure payment options.

- Logistics and Delivery: Retailers are partnering with logistics companies and investing in their own delivery networks to ensure efficient order fulfillment. However, last-mile delivery remains a challenge in some regions with limited infrastructure.

- Social Commerce: Social media platforms play a significant role in the Latin American digital economy. Platforms like Facebook, Instagram, and WhatsApp are used by businesses to showcase and sell their products. Social media influencers also play a crucial role in promoting products and driving sales.

- Government Initiatives: Some countries have implemented policies to improve digital infrastructure, reduce barriers to cross-border trade, and facilitate online payments. Additionally, governments are working to create a favorable regulatory environment for eCommerce businesses.

While the Latin American market is growing, it still faces challenges such as limited internet access in rural areas, low financial inclusion, and concerns about security and trust. However, these challenges also present opportunities for innovative solutions and business models that cater to the unique needs of Latin American consumers.

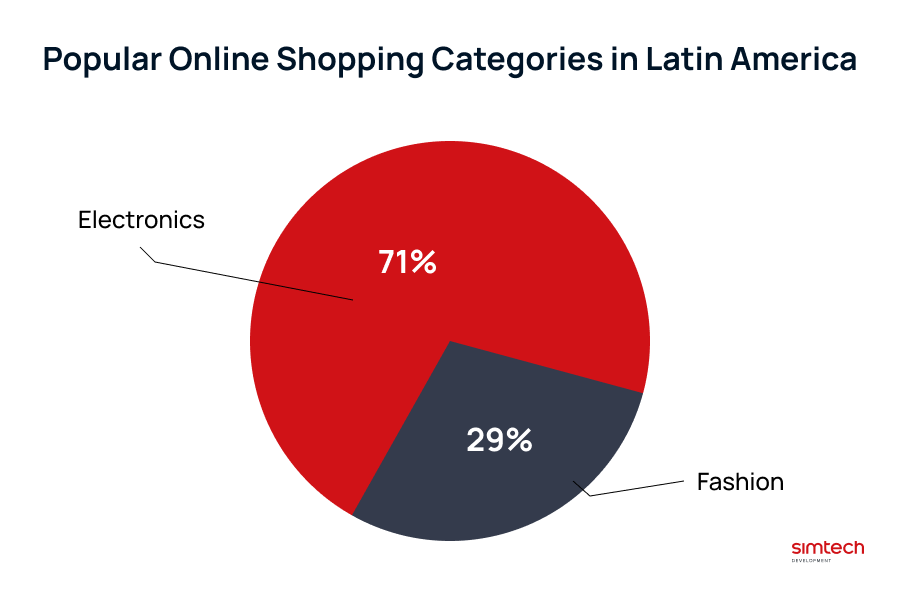

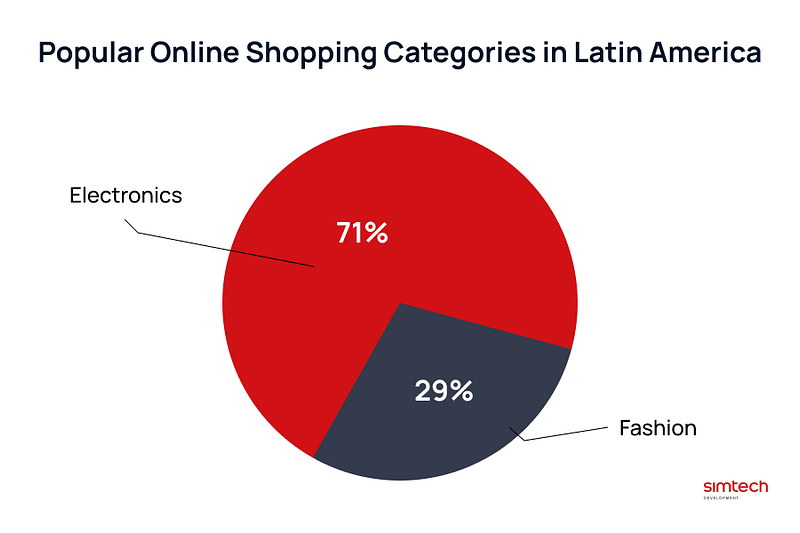

Latin America Shopping Categories

According to Statista, the electronics category has witnessed the biggest online purchase. It is the fastest growing segment and is expected to reach 100 billion USD (out of 140 billion USD of total eCommerce revenues in this region) by 2027. Other popular categories in Latin America include fashion items that would reach revenues of around 60.5 billion USD.

Indian eCommerce market overview

The eCommerce market in India has witnessed tremendous growth over the past decade, driven by factors such as increasing internet penetration, smartphone adoption, and favorable government policies. Some of the key players in the Indian eCommerce market include Flipkart, Amazon India, and Snapdeal. Flipkart, now owned by Walmart, is one of the largest eCommerce platforms in India, offering a wide range of products across various categories. The total online retail sales in India reached approximately $38.5 billion, representing a growth rate of around 23% compared to the previous year. The market is expected to continue expanding in the coming years.

Here is an overview of the Indian market:

- Regional and Local Players: In addition to the major players, there are several regional and local eCommerce platforms in India. Platforms like Myntra, Ajio, and Nykaa cater to specific niche markets and have gained popularity among Indian consumers.

- Marketplaces: Digital platforms like Flipkart and Amazon India are popular among Indian consumers, offering a wide range of products from various sellers. These marketplaces provide a platform for small and medium-sized businesses to reach a larger customer base.

- Payment Methods: Cash on delivery (COD) has been a popular payment method in India due to concerns about online security and a large unbanked population. However, digital payment methods, including mobile wallets (e.g. Paytm, PhonePe) and UPI (Unified Payments Interface) are gaining popularity.

- Rural Market Potential: The rural market in India presents immense potential for eCommerce growth. With increasing internet penetration and initiatives like the Digital India campaign, eCommerce companies are expanding their reach to rural areas and offering products tailored to the needs of rural target audience.

- Government Initiatives: The Indian government has implemented various initiatives to promote eCommerce, including the introduction of the Goods and Services Tax (GST) and the Digital India campaign. These initiatives aim to simplify taxation, improve digital infrastructure, and promote digital payments.

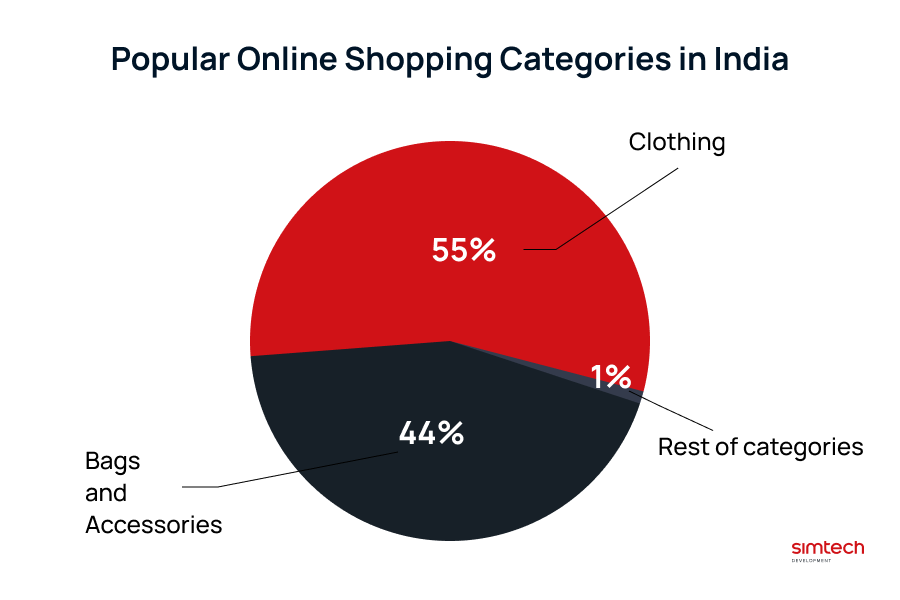

India Online Shopping Categories

Statista surveyed online shopping in India. In 2022 55% and 44% of respondents claimed they bought more often items in the clothing, bags, and accessories segments. Other popular categories in India include electronics, home appliances, beauty and personal care products, books and media, and mobile phones.

Middle East eCommerce market overview

The eCommerce market in the Middle East has been rapidly growing in recent years, driven by factors such as increasing internet penetration, smartphone usage, and a young population. The total online retail sales in the region reached approximately $22 billion, representing a growth rate of around 20% compared to the previous year. Some of the key players in the Middle East market include Souq.com (now Amazon.ae), Noon, and Namshi. Souq.com, acquired by Amazon, is one of the largest eCommerce platforms in the region, offering a wide range of products across various categories. The market is expected to continue expanding in the coming years.

Let’s see an overview of the state of digital economy in the Middle East:

- Cross-Border Shopping: Middle East citizens often order from international eCommerce platforms, particularly from the United States, Europe, and China for a wider product selection and competitive pricing.

- Payment Methods: Cash on delivery (COD) has traditionally been a popular payment method in the Middle East due to concerns about web security and a preference for physical cash. However, digital payment methods, including credit/debit cards and mobile wallets, are gaining popularity.

- Government Initiatives: Governments in the Middle East are taking initiatives to support and promote eCommerce. For example, the United Arab Emirates has launched the Dubai CommerCity, a dedicated free zone for eCommerce companies, to attract investment and facilitate cross-border trade.

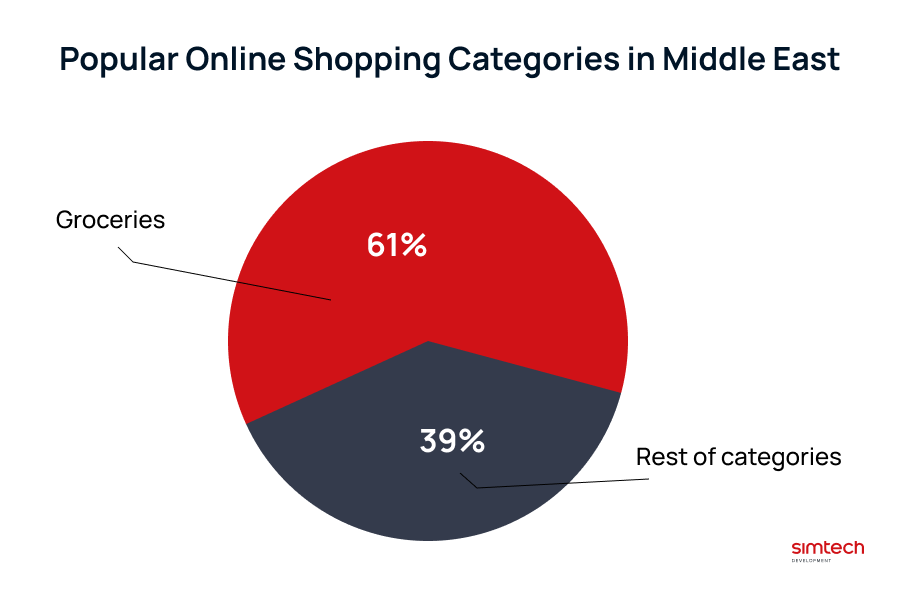

Middle East Online Shopping Categories

61% of the consumers in the MENA (Middle East and North Africa) shopped the most for groceries (Statista). Other popular categories included personal care, toys, and online food delivery.

Asian eCommerce market overview

The eCommerce market in Asia is one of the largest and fastest-growing in the world. With a massive population, increasing internet penetration, and rising disposable incomes, Asia presents immense opportunities for electronic businesses. It is the largest eCommerce market globally, accounting for more than half of global electronic sales. Some of the key players in Asian digital retail include Alibaba Group (including platforms like Tmall and Taobao), JD.com, and Pinduoduo in China, as well as Shopee and Lazada in Southeast Asia. These platforms offer a wide range of products and services, including electronics, fashion, beauty, and more. The total online retail sales in Asia reached approximately $2.6 trillion, representing a growth rate of around 20% compared to the previous year. The market is expected to continue expanding in the coming years.

Here are the key points of the e-market in Asia:

- Payment Methods: While credit/debit cards are commonly used, alternative payment methods such as digital wallets (e.g., Alipay, WeChat Pay, Paytm) and bank transfers are also popular. Cash on delivery (COD) is still prevalent in some markets, particularly in Southeast Asia.

- Logistics and Delivery: Same-day or next-day delivery options are becoming more common, particularly in urban areas.

- Social Commerce: In countries like China, platforms such as WeChat and Weibo have integrated eCommerce features, allowing users to shop a category directly within the app. Influencer marketing and social media advertising are also popular strategies for eCommerce businesses.

Government Initiatives: Governments in Asia are taking initiatives to support and promote eCommerce. For example, China has implemented policies to support cross-border trade.

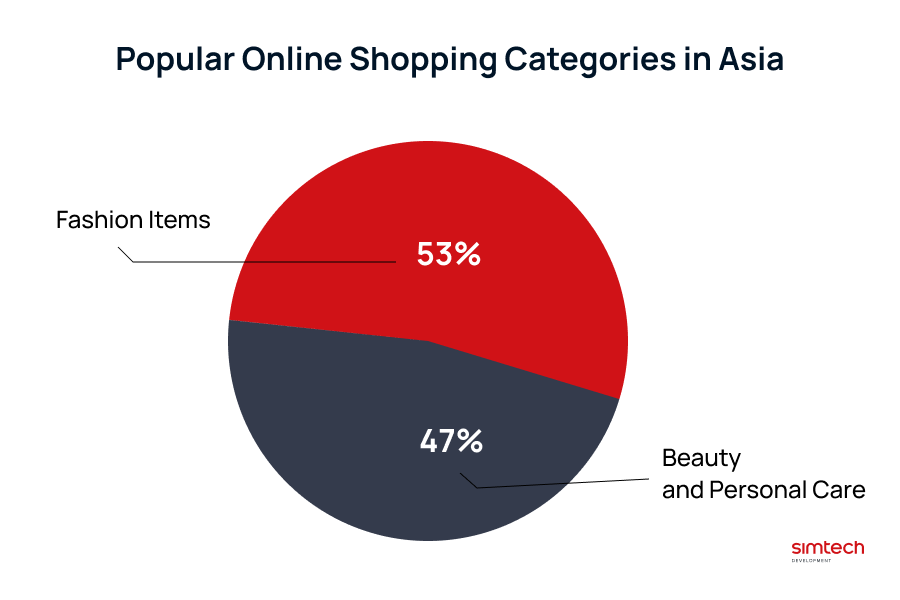

Asia Online Shopping Categories

According to Statista, 53 percent Southeast Asia respondents bought fashion products in 2022. The second most popular online category was beauty and personal care items.

African eCommerce market overview

The eCommerce market in Africa is still relatively small compared to other regions but is growing rapidly. Some of the key players in the African eCommerce market include Jumia, Kilimall, Konga, and Takealot. These platforms offer a wide range of products, including electronics, fashion, beauty, and more. Additionally, global eCommerce players like Amazon and Alibaba are also making investments and expanding their presence in Africa.The total eCom sales in Africa reached approximately $19.8 billion, representing a growth rate of around 40% compared to the previous year. The market is expected to continue expanding in the coming years.

Let’s overview the eCommerce market in Africa:

- Mobile Commerce: Mobile commerce, or m-commerce, is a significant driver of the eCommerce market in Africa. With low PC penetration but high smartphone adoption rates, consumers in Africa often access the internet and shop online through their mobile devices. eCommerce platforms have adapted their strategies to cater to this trend, offering mobile-friendly websites and apps.

- Cross-Border Trade: Consumers often order from international eCommerce platforms, particularly from China, Europe, and the United States, for a wider product selection and competitive pricing. This trend has led to an increase in the availability of cross-border shipping options.

- Payment Methods: Payment methods vary across different African countries. While credit/debit cards are commonly used, alternative payment methods such as mobile money (e.g., M-Pesa, Orange Money) and cash on delivery (COD) are also popular. eCommerce platforms have been partnering with local payment providers to offer convenient and secure payment options.

- Informal Economy: The informal economy is prevalent in Africa, and eCommerce is gradually formalizing this sector. Many small businesses and entrepreneurs are leveraging eCommerce platforms to reach a wider customer base and expand their businesses. This trend is contributing to economic growth and job creation.

While the African eCommerce market is growing, it still faces challenges such as limited internet access in rural areas, low financial inclusion, and logistical difficulties. However, these challenges also present opportunities for innovative solutions and business models that cater to the unique needs of African consumers.

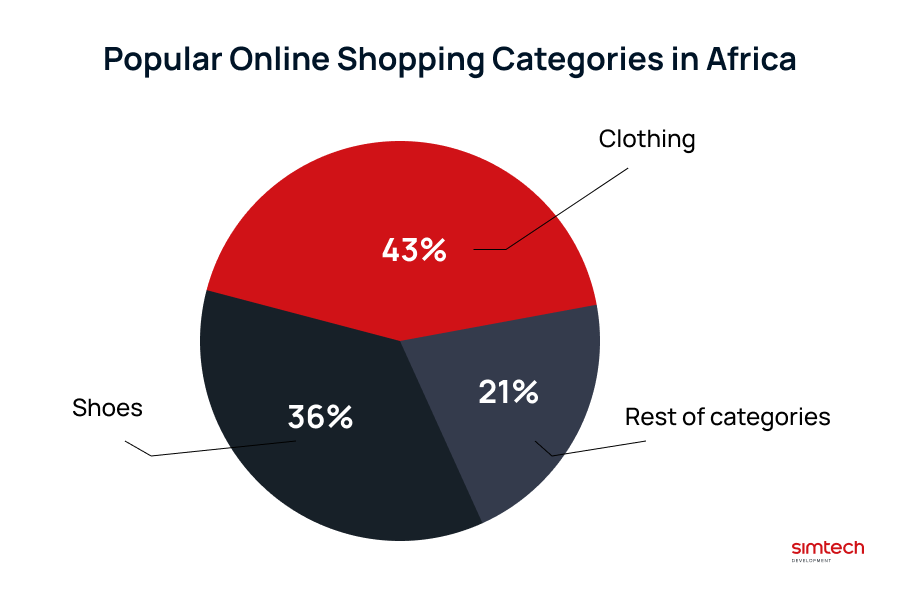

Africa Online Shopping Categories

In 2023, among South African customers, the two most popular segments for online purchases were Clothing and Shoes (43 % and 36% of respondents respectively answered they shopped for these items online more often during the year).

Read more articles about product and categories to sell:

Conclusion

To find more trending product ideas, explore Google trends, in addition to considering the statistics from our overview. Knowing the trends in shopping across the world is crucial for sourcing and marketing the right product categories in your eCommerce business. Take the right actions and get more profit out of your effort with a wise strategy! We’ll be scanning the market statistics to bring you more insights on international expansion opportunities. If you’re itching to test cross-border sales and launch a local storefront anywhere in the world, feel free to use our expertise and assistance.